401k Limit 20245u304l9npaz5. The lifetime rollover limit is $35,000. Learn how much you can save for retirement in 2024 with the irs contribution limits for various plans, such as 401 (k), 403 (b), 457 (b), and ira.

The limit on employer and employee contributions is $69,000. The limit for employer and employee contributions.

401k Limit 20245u304l9npaz5 Images References :

Source: almetaykendra.pages.dev

Source: almetaykendra.pages.dev

Roth 401k Limit 2024 Fidelity Rodie Chrysler, Learn how income limits affect your 401 (k) contributions and employer match in 2023 and 2024.

Source: faydrabyelena.pages.dev

Source: faydrabyelena.pages.dev

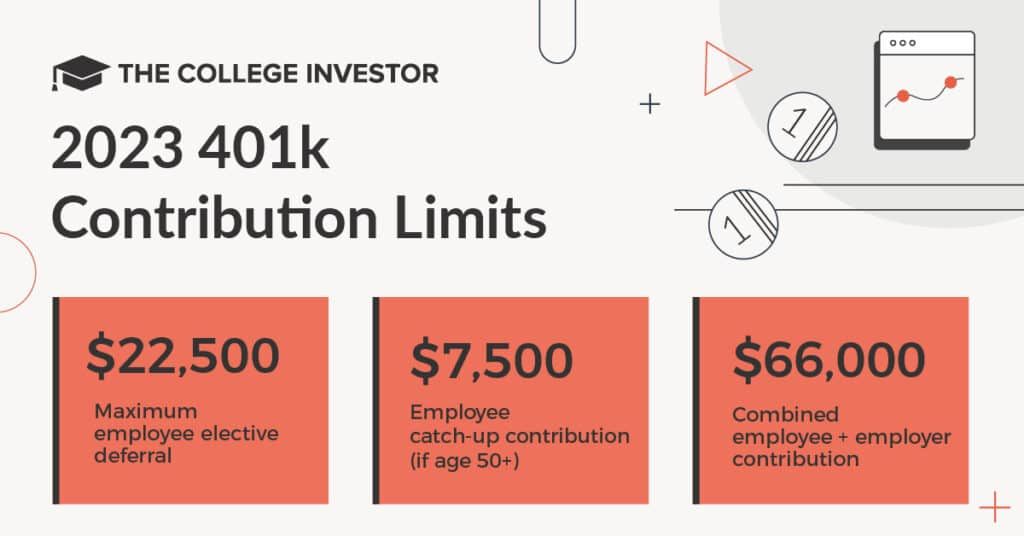

401 K Limits 2024 Catch Up 2024 Bert Marina, The roth 401(k) contribution limit in 2023 is $22,500 for employee contributions and $66,000 total for both employee and employer contributions.

Source: sianayedeline.pages.dev

Source: sianayedeline.pages.dev

What Is The 401k Limit 2024 Berni Cecilla, The roth 401(k) contribution limit in 2023 is $22,500 for employee contributions and $66,000 total for both employee and employer contributions.

Source: sianayedeline.pages.dev

Source: sianayedeline.pages.dev

What Is The 401k Limit 2024 Berni Cecilla, Learn how income limits affect your 401 (k) contributions and employer match in 2023 and 2024.

Source: adenayolenka.pages.dev

Source: adenayolenka.pages.dev

401k Contribution Limits 2024 Employer Matching 2024 Carla Cosette, Those 50 and older can save an.

Source: sofiebjacquie.pages.dev

Source: sofiebjacquie.pages.dev

2024 401k Contribution Catch Up Limit Mead Stesha, Find out the latest irs limits for 401 (k), 403 (b), 457 (b), ira, hsa, and other retirement accounts in 2025.

Source: lissaycarolee.pages.dev

Source: lissaycarolee.pages.dev

401 K Plan Contribution Limits 2024 Employer Match Lilla Patrice, Find out when and how the irs.

Source: bilibgennifer.pages.dev

Source: bilibgennifer.pages.dev

2024 401k Maximum Contribution Limits Over 55 Fania Jeanine, Those 50 and older can save an.

Source: sharaylynnet.pages.dev

Source: sharaylynnet.pages.dev

401k Limits 2024 Over 50 Misti Teodora, Learn how much you can save for retirement in 2024 with the irs contribution limits for various plans, such as 401 (k), 403 (b), 457 (b), and ira.

Source: diannyrosalynd.pages.dev

Source: diannyrosalynd.pages.dev

401k Limits For 2024 Over Age 55 Jemie Melisenda, This includes contributions made to any ira.