Estimated Tax Payments Schedule 2024. And those dates are roughly the same each year: View the amount you owe, your payment plan details, payment history, and any scheduled or pending payments.

2024 estimated tax payment deadlines. The deadlines for tax year 2024 quarterly payments are:

In 2024, Estimated Tax Payments Are Due April 15, June 17, And September 16.

The deadlines for tax year 2024 quarterly payments are:

Make A Same Day Payment From Your Bank.

Before you start thinking about your 2024 estimated taxes, you need to make the last of your 2023 estimated tax payments.

There Are Four Payment Due Dates.

Images References :

Source: celkaqminetta.pages.dev

Source: celkaqminetta.pages.dev

Irs All Tax Deadline Dates For 2024 Amitie Andriette, The estimated tax payments are due quarterly. If the corporation does not pay the.

Source: www.youtube.com

Source: www.youtube.com

Learn How to Fill the Form 1040ES Estimated Tax for Individuals YouTube, 2024 estimated tax payment deadlines. 2q — june 17, 2024;

Source: www.veche.info

Source: www.veche.info

2022 Tax Refund Schedule Chart Irs » Veche.info 28, Before turning your attention to 2024, the final estimated tax payment of 2023 is due on january 16th, 2024. We'll make it easy for you to.

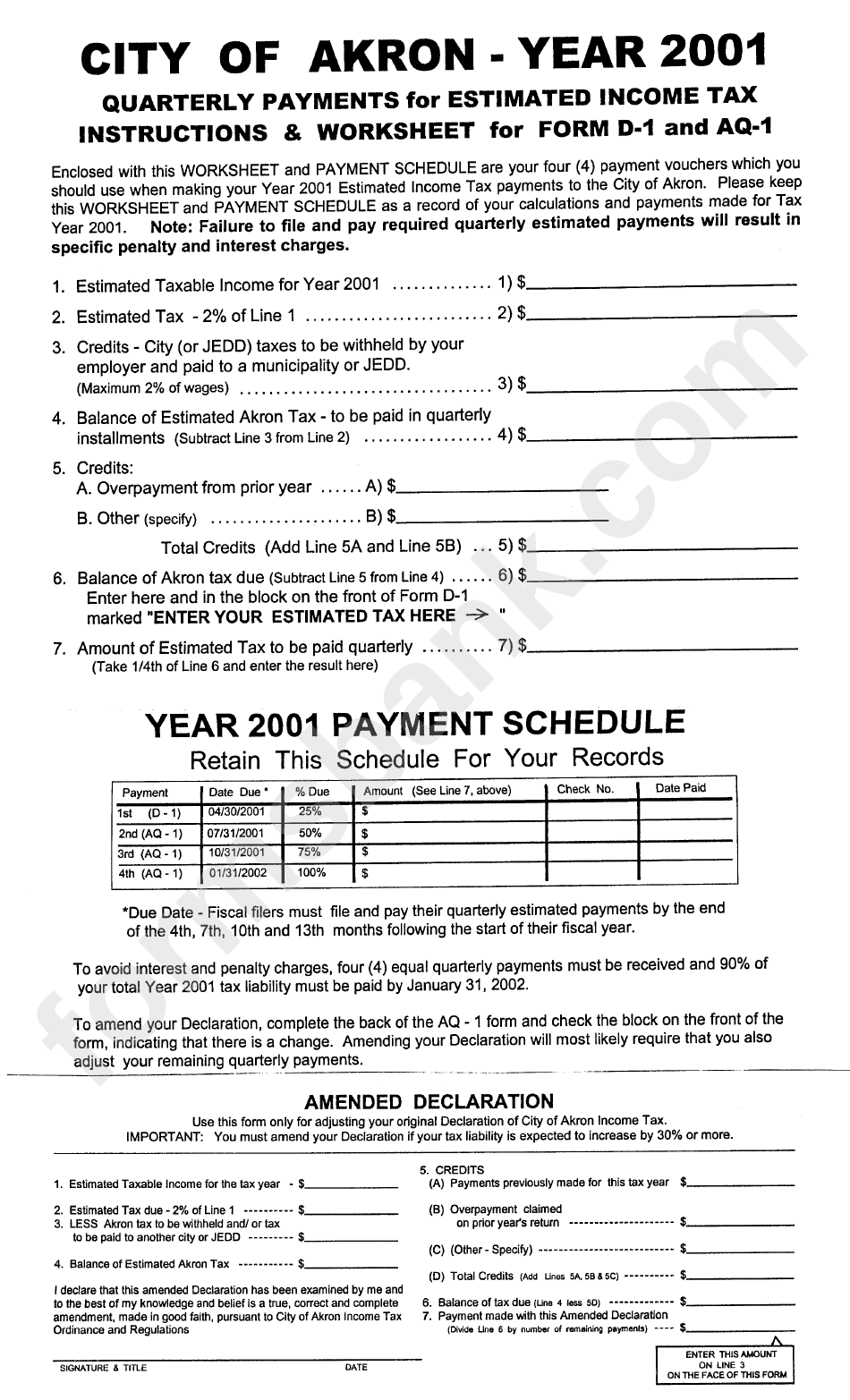

Source: www.formsbank.com

Source: www.formsbank.com

Quarterly Payments For Estimated Tax Form printable pdf download, The estimated tax payments are due quarterly. How to make estimated tax payments and due dates in 2024.

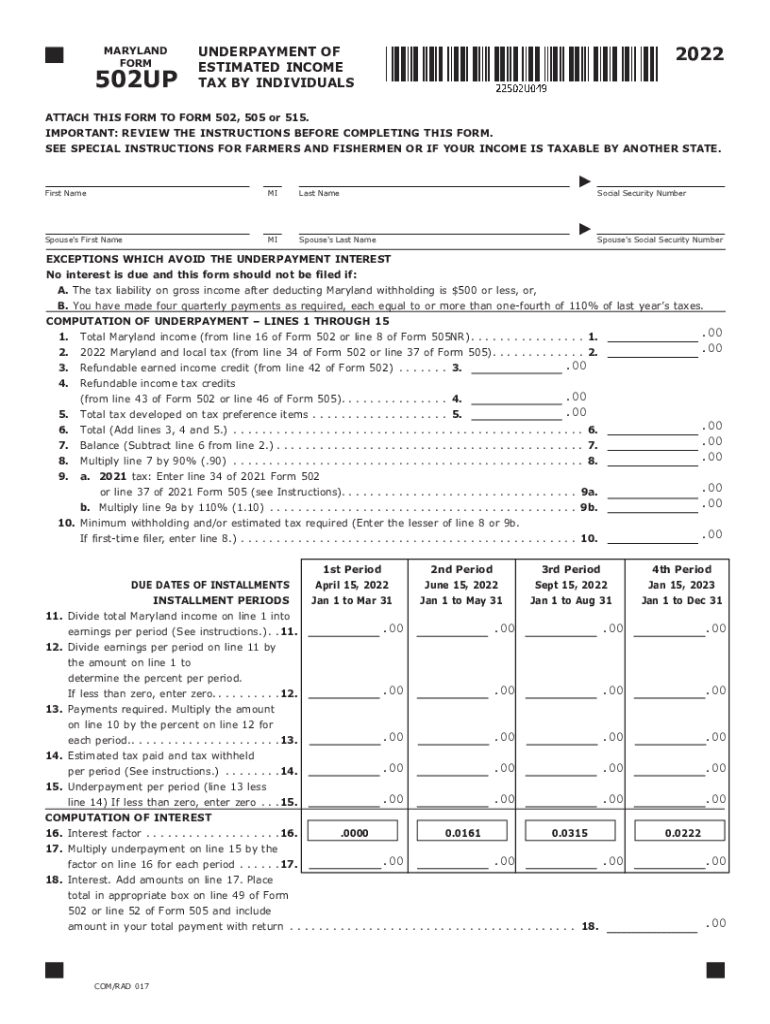

Source: www.signnow.com

Source: www.signnow.com

Maryland Estimated Tax Vouchers 20222024 Form Fill Out and Sign, For calendar year filers, estimated payments are due april 15, june 15, and september 15 of the taxable year and january 15 of the following year. 1q — april 15, 2024;

Source: www.pdffiller.com

Source: www.pdffiller.com

Pa Estimated Tax Form Fill Online, Printable, Fillable, Blank pdfFiller, The final quarterly payment is due january 2025. The deadlines for tax year 2024 quarterly payments are:

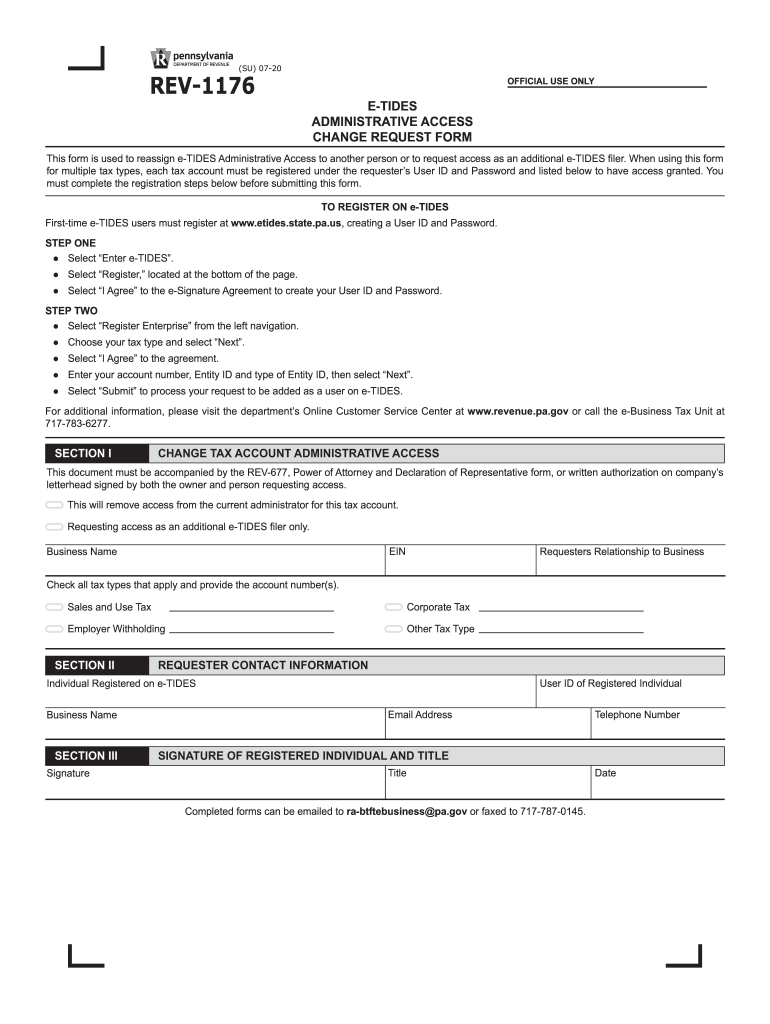

Source: www.pdffiller.com

Source: www.pdffiller.com

20202024 Form PA REV1176 Fill Online, Printable, Fillable, Blank, If you don’t pay enough tax, either through withholding or estimated tax, or a. Make a same day payment from your bank.

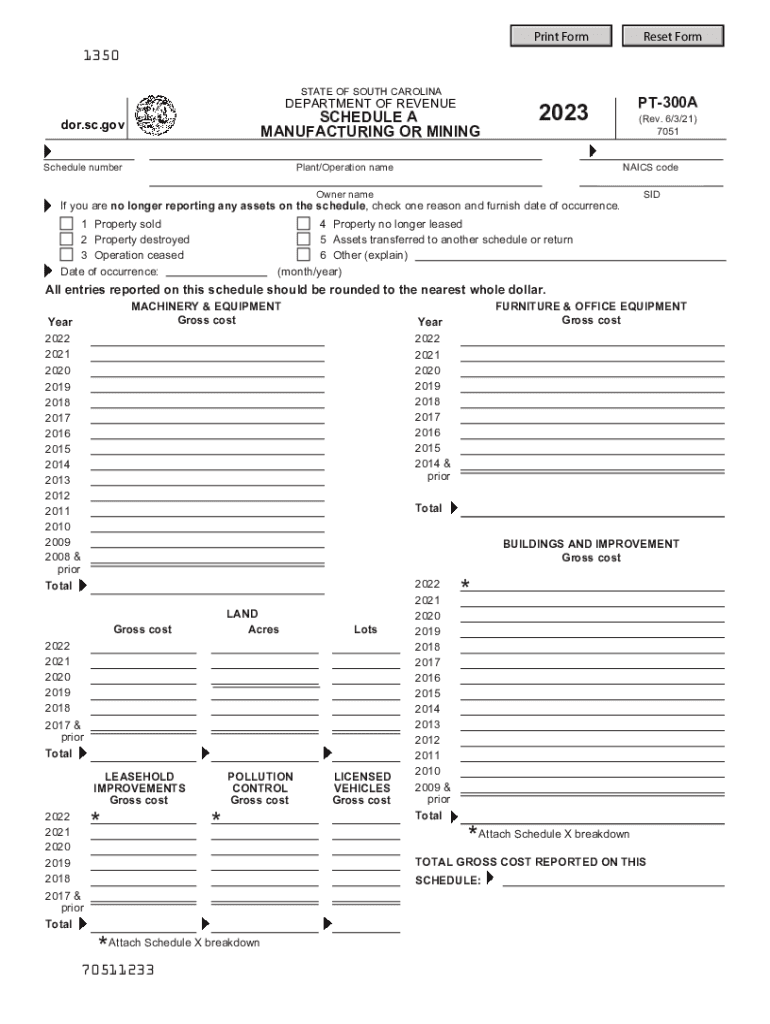

Source: www.dochub.com

Source: www.dochub.com

2023 pt 300a Fill out & sign online DocHub, This interview will help you determine if you’re required to make estimated tax payments for 2024 or if you meet an exception. Washington — the internal revenue service today suggested taxpayers who filed or are about to file their 2022 tax return use the irs tax withholding estimator.

Source: jackquelinewjania.pages.dev

Source: jackquelinewjania.pages.dev

1040 Schedule A 2024 Tax Klara Michell, The estimated tax payments are due quarterly. This document provides statements or interpretations of the following laws and regulations enacted as of january 16, 2024:

Source: www.pinterest.com

Source: www.pinterest.com

Form 1040 ES, Estimated Tax for Individuals Internal Revenue Service, Make a same day payment from your bank. If the corporation does not pay the.

2Q — June 17, 2024;

Estimated quarterly tax payments are due four times per year, on.

This Interview Will Help You Determine If You’re Required To Make Estimated Tax Payments For 2024 Or If You Meet An Exception.

If you don’t pay enough tax, either through withholding or estimated tax, or a.