Kansas Electric Vehicle Incentives. Kansas electric vehicle incentives include one utility rebate. Kansas residents who purchase an ev may also qualify for the federal electric car tax credit of up to $7,500.

Electricity sources and vehicle emissions. To help kansas’s electric vehicle owners understand the incentives available to them, we have created a list of.

Kansas Has The Following Incentives In Place For Electric Vehicles And Associated Purchases For Charging:

Bob north, general counsel for the kansas department of commerce, speaks to lawmakers in 2023.

Federal Ev Tax Credit Incentive #3:

Beyond the ban on direct sales, kansas also punishes ev consumers with higher license and registration fees.

The Standard Registration Fee For Vehicles In Kansas.

Images References :

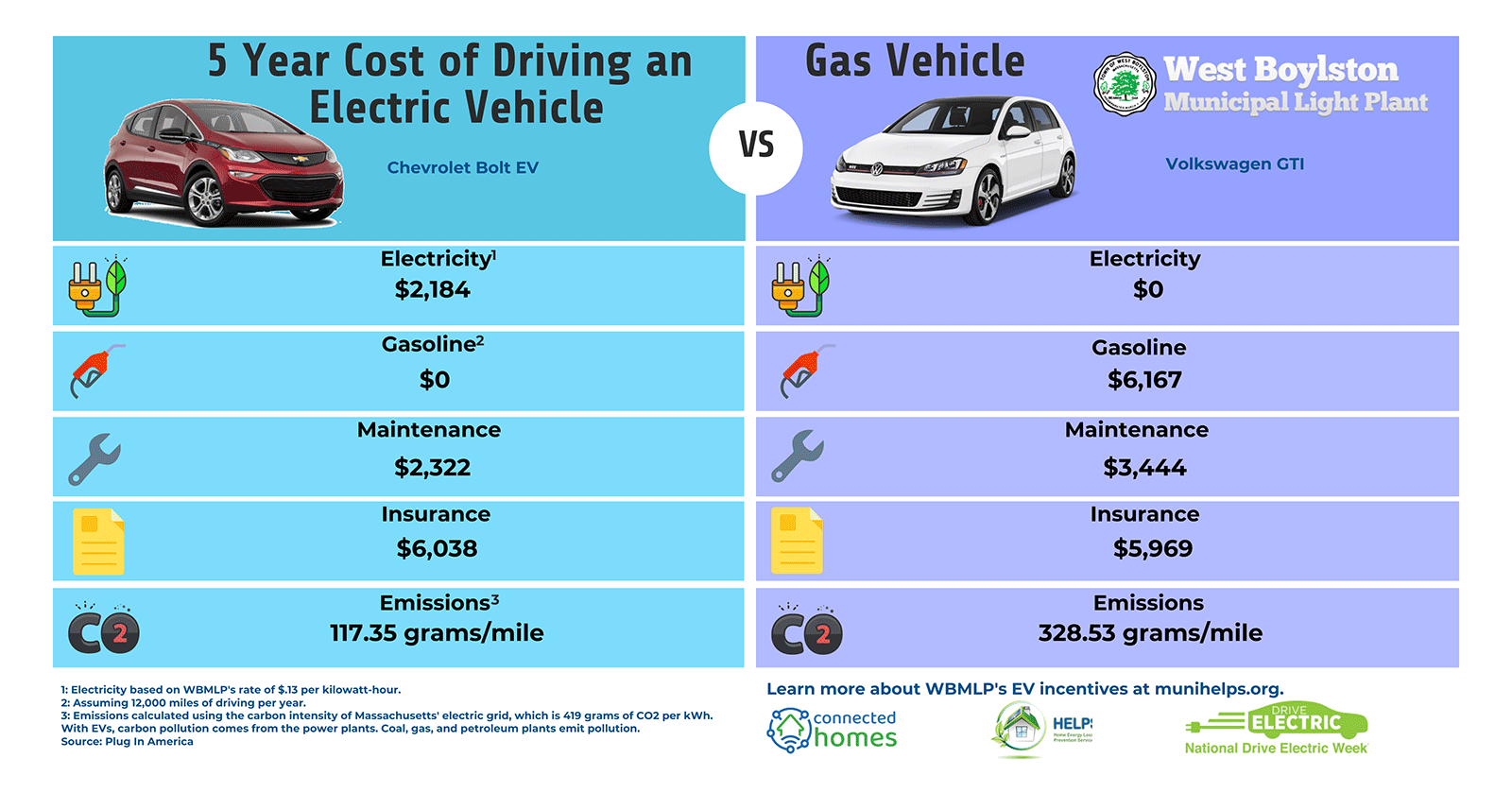

Source: wbmlp.org

Source: wbmlp.org

Electric Vehicle (EV) Incentives & Rebates, Kansas residents who purchase an ev may also qualify for the federal electric car tax credit of up to $7,500. Electricity sources and vehicle emissions.

Source: www.constellation.com

Source: www.constellation.com

Electric Vehicle Tax Incentives & Rebates Guide Constellation, The buyer income limits are $75,000 for single filers, $112,500 for heads of. Kansas electric vehicle incentives include one utility rebate.

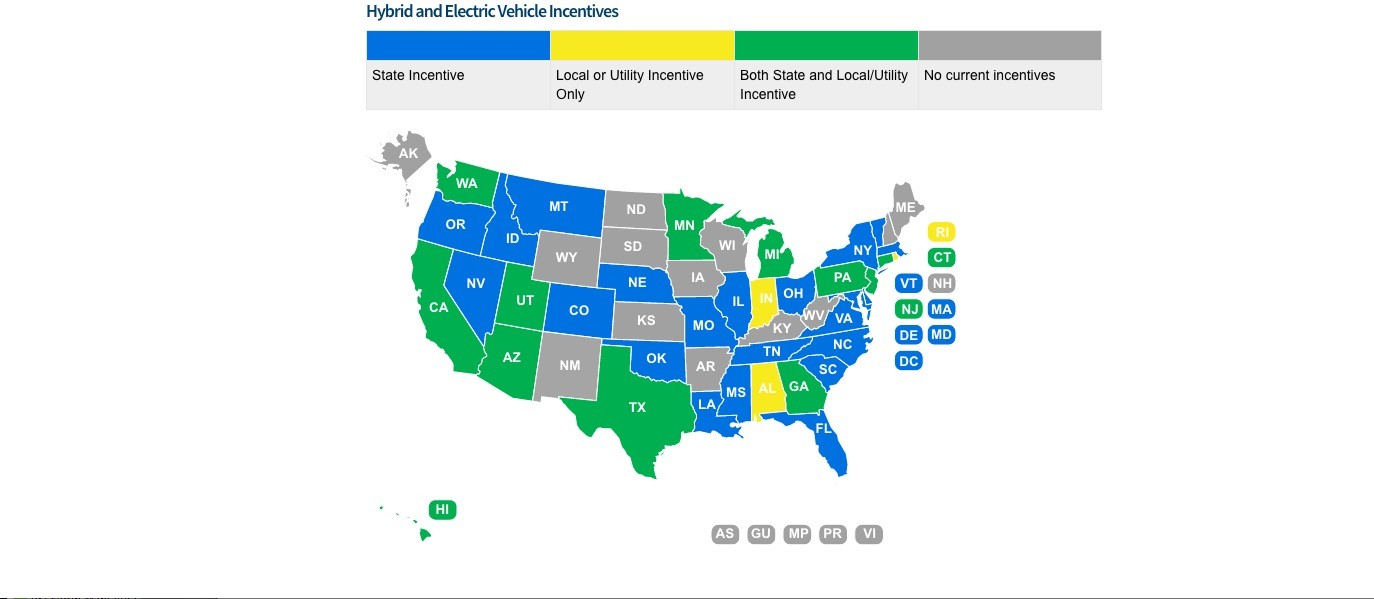

Source: www.thezebra.com

Source: www.thezebra.com

Going Green States with the Best Electric Vehicle Tax Incentives The, Depending on the vehicle, you may also qualify for a $7500 federal tax. Kansas residents who purchase an ev may also qualify for the federal electric car tax credit of up to $7,500.

Source: evtaxincentives.com

Source: evtaxincentives.com

Kansas Electric Vehicle Incentives, Rebates and Tax Credits, Electricity sources in kansas wind: The kansas corporation commission (kcc) approved a settlement agreement negotiated between its staff, the citizens utility ratepayer board (curb).

Source: www.autoevolution.com

Source: www.autoevolution.com

Electric Car and PlugIn Hybrid Incentives in the USA A Quick Guide, Kansas electric vehicle incentives include one utility rebate. Depending on the vehicle, you may also qualify for a $7500 federal tax.

Source: www.weforum.org

Source: www.weforum.org

These Countries Offer The Best Electric Car Incentives to Boost Sales, The standard registration fee for vehicles in kansas. Likewise wants to incentivize the production.

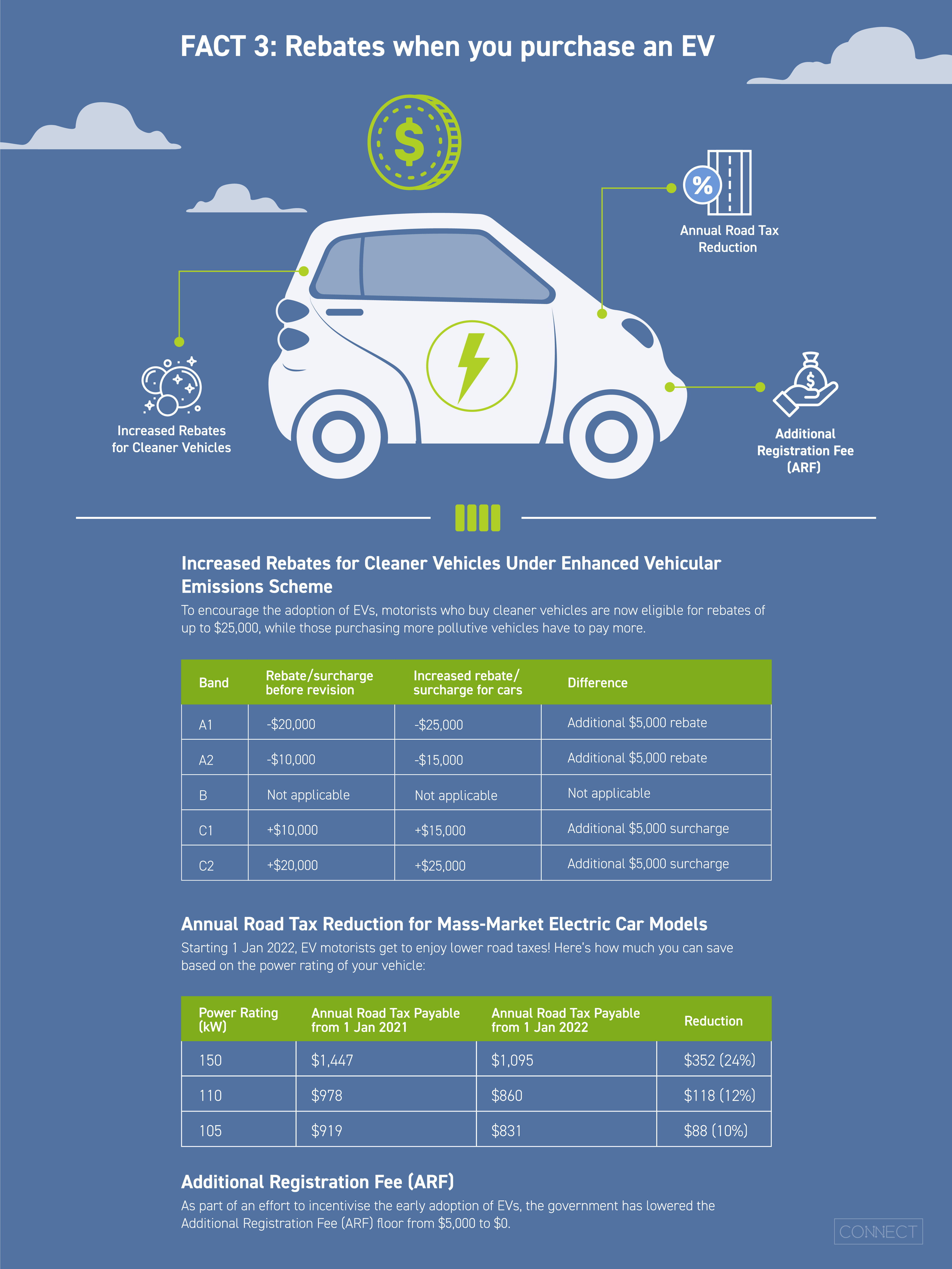

Source: www.lta.gov.sg

Source: www.lta.gov.sg

LTA 8 Facts to Charge Up Your Knowledge About Electric Vehicles, Kansas residents should also check with their local electric utilities for any additional. Bob north, general counsel for the kansas department of commerce, speaks to lawmakers in 2023.

Source: www.reliant.com

Source: www.reliant.com

Electric Car EV Tax Incentives and Rebates Reliant Energy, Kansas electric vehicle incentives include one utility rebate. Origin of battery components ($3,750 tax credit) moving back to the assembly side, the u.s.

Source: www.carrebate.net

Source: www.carrebate.net

Electric Car Available Rebates 2023, State incentives kansas' national electric vehicle infrastructure (nevi) planning. The buyer income limits are $75,000 for single filers, $112,500 for heads of.

Source: www.apexcleanenergy.com

Source: www.apexcleanenergy.com

Encouraging New Choices Through Incentives for Electric Vehicles Apex, The used ev tax credit equals 30% of the sales price and maxes out at $4,000. State incentives kansas' national electric vehicle infrastructure (nevi) planning.

The Buyer Income Limits Are $75,000 For Single Filers, $112,500 For Heads Of.

Government utility regulators authorized a plan to promote electric vehicles in kansas, but.

Department Of Transportation’s (Dot) Nevi Formula Program Requires The Kansas Department Of Transportation (Ksdot) To Submit An Annual Ev Infrastructure.

Origin of battery components ($3,750 tax credit) moving back to the assembly side, the u.s.